Debt investor information

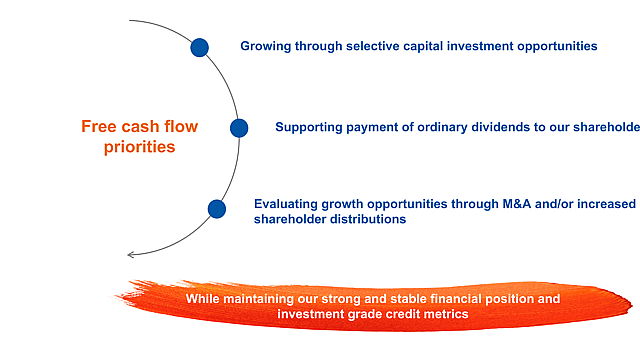

We have a strong platform for growth underpinned by our robust financial position and investment grade credit ratings.

Our capital structure

We aim to manage our cost of capital by maintaining an appropriate capital structure, with a balance between equity and debt. The primary sources of the Group’s net debt include our €3 billion Guaranteed Euro Medium Term Note Programme, our €750 million syndicated revolving credit facility and financing from various banks and other credit agencies, thus providing us with access to diverse sources of debt financing with varying debt maturities.

Credit ratings

Standard & Poor's long-term credit rating (Outlook: stable)

Moody's long-term credit rating (Outlook: stable)

Ratings and downloads

Credit ratings

| Agency | Long term | Outlook |

| Standard & Poor's | A- | Stable |

| Moody's | Baa1 | Stable |

Our latest debt investor presentation

Mondi Finance plc's financial statements

- Mondi Finance plc's financial statements 2023

- Mondi Finance plc's financial statements 2022

- Mondi Finance plc’s financial statements 2021

- Mondi Finance plc’s financial statement 2020

- Mondi Finance plc’s financial statement 2019

- Mondi Finance plc’s financial statement 2018

- Mondi Finance plc’s financial statement 2017

- Mondi Finance plc’s financial statement 2016

- Mondi Finance plc’s financial statement 2015

- Mondi Finance plc’s financial statement 2014

- Mondi Finance plc’s financial statement 2013

- Mondi Finance plc’s financial statement 2012

- Mondi Finance plc’s financial statement 2011

- Mondi Finance plc’s financial statement 2010

- Mondi Finance plc’s financial statement 2009

Mondi Finance plc Articles of Association are available here.

Mondi Finance Europe GmbH’s financial statements

- Mondi Finance Europe GmbH's financial statements 2022

- Mondi Finance Europe GmbH’s financial statements 2021

- Mondi Finance Europe GmbH’s financial statements 2020

Mondi Finance Europe GmbH's Articles of Association are available here.