Key performance indicators

Our KPIs offer an insight into how we're performing against our long-term strategic focus on delivering value accretive growth, sustainably.

Delivering against our strategy in 2023

Our key performance indicators provide a broad measure of our performance and value creation. Financial KPIs are presented for a five-year period and based on the Group’s continuing operations from 2021, while sustainability metrics are presented from their respective baseline years and therefore either cover a four- or five-year period (with all years, including baselines, based on the Group’s continuing operations).

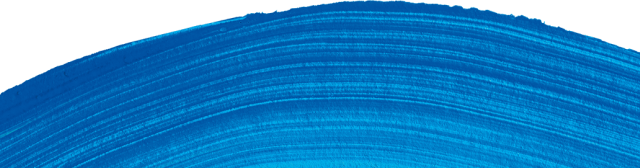

Underlying EBITDA

Why this is a KPI

Underlying EBITDA provides a measure of the cash-generating ability of the Group that is comparable from year to year. Tracking our cash generation is one of the components we measure when we assess our value creation through the cycle.

2023 performance

Underlying EBITDA was lower at €1,201 million due to lower sales volumes and selling prices falling more than input costs. The Group’s underlying EBITDA margin was 16.4%.

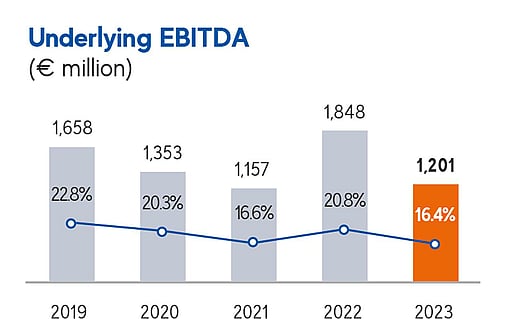

Return on capital employed (ROCE)

Why this is a KPI

ROCE provides a measure of the efficient and effective use of capital in our operations. We compare ROCE to our current estimated Group pre-tax weighted average cost of capital to measure the value we create.

2023 performance

The Group achieved a ROCE of 12.8%, ahead of cost of capital although lower than 2022, reflecting the lower profitability in the year.

Investment grade credit rating

Why this is a KPI

We aim to maintain investment grade credit ratings to ensure we have access to funding for value accretive investment opportunities through the business cycle.

2023 performance

The Group maintained its investment grade credit ratings. In May 2023, Standard & Poor’s upgraded the Group's credit rating from BBB+ to A- (stable outlook). Moody’s Investors Service reaffirmed the Group's credit rating at Baa1 (stable outlook) during the year.

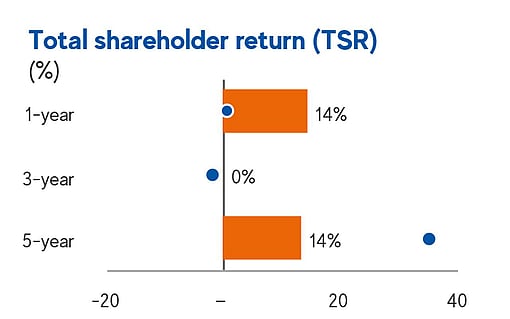

Total Shareholder Return (TSR)

Why this is a KPI

TSR provides a market-related measure of the Group’s progress against our objective of delivering long-term value for our shareholders. TSR measures the total return to Mondi’s shareholders, including both share price movement and dividends paid.

2023 performance

The Group achieved a TSR of 14% in the year and recommended a total ordinary dividend per share for the year of 70.0 euro cents, in line with last year.

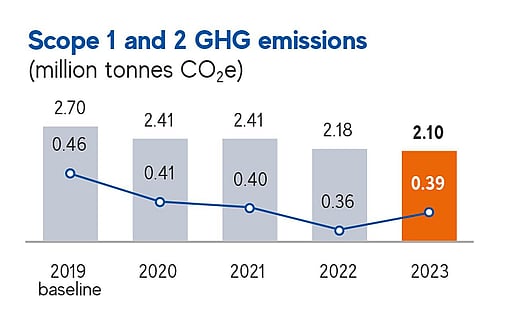

Scope 1 and 2 GHG emissions

Why this is a KPI

Our focus is to reduce our GHG emissions to address climate-related impacts and secure the long-term success of our business.

2023 performance

We have reduced our absolute Scope 1 and 2 GHG emissions by 22% compared to our 2019 baseline and remain on track to meet our targets. Our GHG emission intensity from our pulp and paper mills was higher at 0.39 t/t (or 0.43 t/t for the Group including converters) mainly due to market-related lower production volumes.

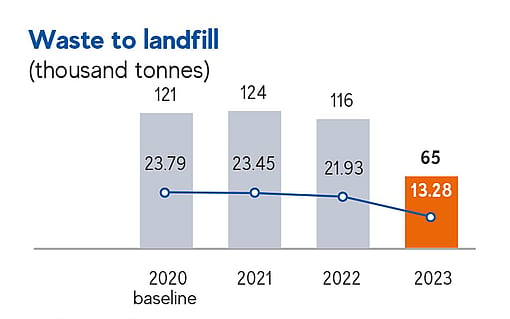

Waste to landfill

Why this is a KPI

Our goal is to keep materials in circulation. We are focused on reducing our waste and reusing or recycling unavoidable waste generated in our production processes instead of disposing of it to landfill.

2023 performance

We continue to make progress against our ambition to eliminate waste to landfill and have successfully reduced our specific waste to landfill by 44% compared to our 2020 baseline.

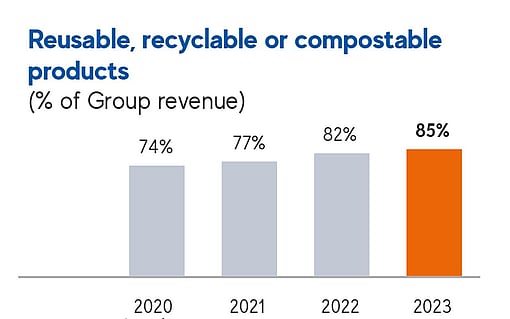

Reusable, recyclable or compostable products

Why this is a KPI

The demand for sustainable packaging continues to rise, with brands and consumers looking for solutions to help meet their sustainability pledges and support the transition to a circular economy.

2023 performance

We continue to make progress on our ambitious target. In 2023, 85% of our revenue was from products that were reusable, recyclable or compostable, up from 74% in 2020, our baseline year for this target.

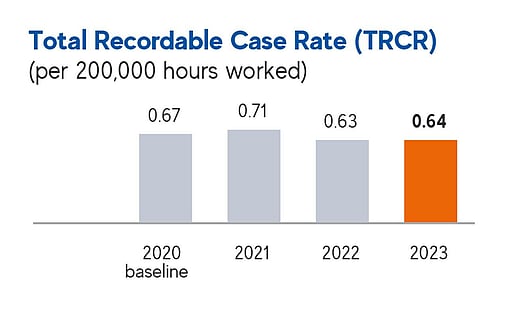

Total Recordable Case Rate (TRCR)

Why this is a KPI

Keeping people safe and healthy is a moral and a business imperative that applies to all who work for and on behalf of Mondi. Our 24-hour safety mindset supports our goal of sending everybody home safely, every day.

2023 performance

Among industry leaders with a 0.64 Total Recordable Case Rate performance. We however deeply regret the fatality at our Ružomberok facility (Slovakia) and in addition, the four life-altering injuries at our operations in the year.

Delivering value accretive growth, sustainably