Driving eCommerce growth in the next five years through expert analysis and key value strategies

Navigating the eCommerce sector requires agility and foresight, especially amid rapid socio-economic changes, from the aftermath of Covid-19 to the rising cost of living.

Recent shifts in the world of online shopping — such as the growth of social commerce, increased consumer advocacy, and a focus on sustainability — signal a pivotal moment for strategic decisions fostering eCommerce growth. Effective growth strategies in eCommerce require constant adaptation. Here are some of the latest insights from leading experts in McKinsey, Statista, and RetailX that shed light on the current state of affairs to prepare businesses for the evolving market dynamics.

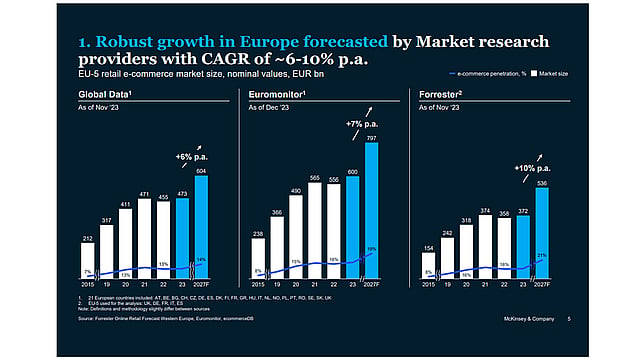

Rebalanced growth

eCommerce is stabilising to pre-Covid growth rates, with sectors like fashion, electronics, and Fast-Moving Consumer Goods (FMCG) dominating online sales. Despite a slight dip in 2023, research from McKinsey, Global Data, Euromonitor and Forrester anticipates a robust compound annual growth rate (CAGR) of 6–10% per year.

Circularity and value sensitivity

The rise of the circular economy is reshaping consumer expectations. Customers are increasingly drawn to recycled, refurbished, and/or sustainably produced products. This is spurred by conscious purchasing, consumer activism, and a persistent belief in the cost advantages of online and second-hand shopping. Statista projects a 75% increase in Consumer-to-Consumer (C2C) revenue by 2029, highlighting the growing appeal of second-hand and sustainable consumer practices.

Demand for sustainable and compliant packaging

Consumer demand and statutory requirements like the Packaging & Packaging Waste Regulation (PPWR) are driving the push for more sustainable packaging solutions. This trend underscores the need for eCommerce-specific innovations that align with environmental expectations.

Nedim Nisic, Mondi Group eCommerce Director, acknowledges these changes as catalysts for advanced eCommerce packaging solutions:

“We have consumer demand and the regulatory push both driving developments in eCommerce packaging. For example, we have seen shipping-in-own-container (SIOC) as increasingly preferred as a way to reduce waste and this makes our efforts to create ever-more sustainable solutions more relevant.”

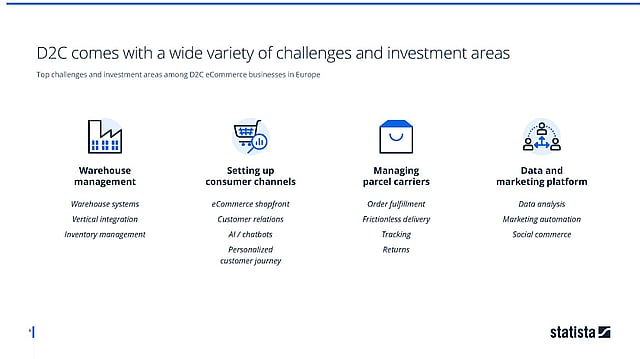

The rise of circular business models

Direct-to-Consumer (D2C) and C2C sales models are flourishing, offering brands direct avenues to engage with consumers and capitalise on market opportunities. According to RetailDive, companies like Nike and Adidas have successfully leveraged D2C strategies to enhance their market presence. Due to Gen Z's enthusiasm for eco-friendly and affordable shopping options, platforms like Etsy and Vinted are also thriving in the C2C market.

Statista outlines that companies such as LuluLemon experienced a three-fold increase from 2019 to 2023 in D2C sales. Again, the fashion industry has been on top, but other sectors, such as electronics and personal care, are showing promise. Yet D2C and C2C marketplaces pose unique challenges. Koen van Gelder, Team Lead at Statista, summarises:

“If you, as a manufacturer, want to think about selling directly to consumers first, thinking about warehouse management should be a first step. Setting up consumer channels involves creating an eCommerce shop front with customer service, potentially using AI chatbots. Managing parcel carriers and handling returns and packaging are critical for direct sellers.”

Innovative and sustainable packaging solutions

Mondi Group’s annual eCommerce trend report, Key eCommerce trends and customer attitudes to packaging in Europe, in partnership with RetailX, reveals insights from over 6,000 consumers in the Czech Republic, France, Germany, Poland, Sweden and Türkiye. Ian Jindal, CEO at RetailX, highlights that consumers, especially Gen Z, have high expectations for packaging:

“When we ask customers what’s important to them regarding packaging, lots of things come up. Protection of goods is #1 of course, however, they also want the packaging to be easy to return, reseal and resend. They want it to be recyclable and reusable. Especially Gen Z, whenever they buy something, they’ll look at the box and think, ‘ah, this is great, I can use this to package up my Depop or my Vinted purchase’ then go away and store their collection of boxes ready to resell goods on the C2C market and be mini entrepreneurs.”

Additionally, when consumers observe a company's endeavour to decrease packaging and be more environmentally conscious, it bodes well for the reputation of the brand. 57% of Gen Z and 53% of Millennials notice these recent brand efforts in using more sustainable packaging.

Another interesting insight is that over half the audience, according to the survey, wants to see more of Shipping in Own Container (SIOC). Across all generations (Gen Z, Millennials, Gen X and Boomers), over 50-60% want to see products in their own branded packaging without any additional packaging “always” or “most of the time”. Considering prevailing sentiments aiming to combine a luxurious experience and sustainability, it's important for retailers to keep in mind “it’s not just a box.”

Latest eCommerce packaging news and insights

More on eCommerce packaging

Discover our innovative and fit-for-purpose eCommerce packaging products that are sustainable by design.

.png?stamp=243d99d1ef4cf153b0de41bbff42f5139b6b4d60)